Growing annuity formula excel

When you check the growing and initial cash flow at g make sure its sufficient. PMT is the amount of each payment.

Growing Annuity Formula With Calculator Nerd Counter

If you were trying to figure out the present value.

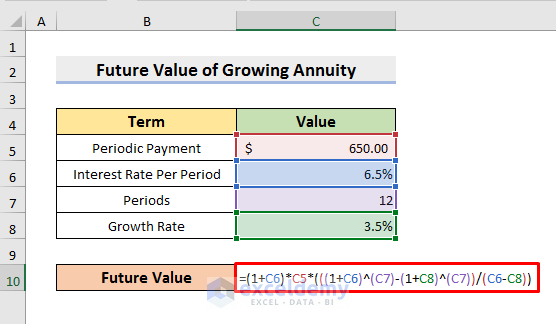

. Payments are made annually. The formula for Future Value of an Annuity formula can be calculated by using the following steps. Future Value of a Growing Annuity Formula.

Insert Formula for Growing Ordinary Annuity. N Number of periods. Related Art See more.

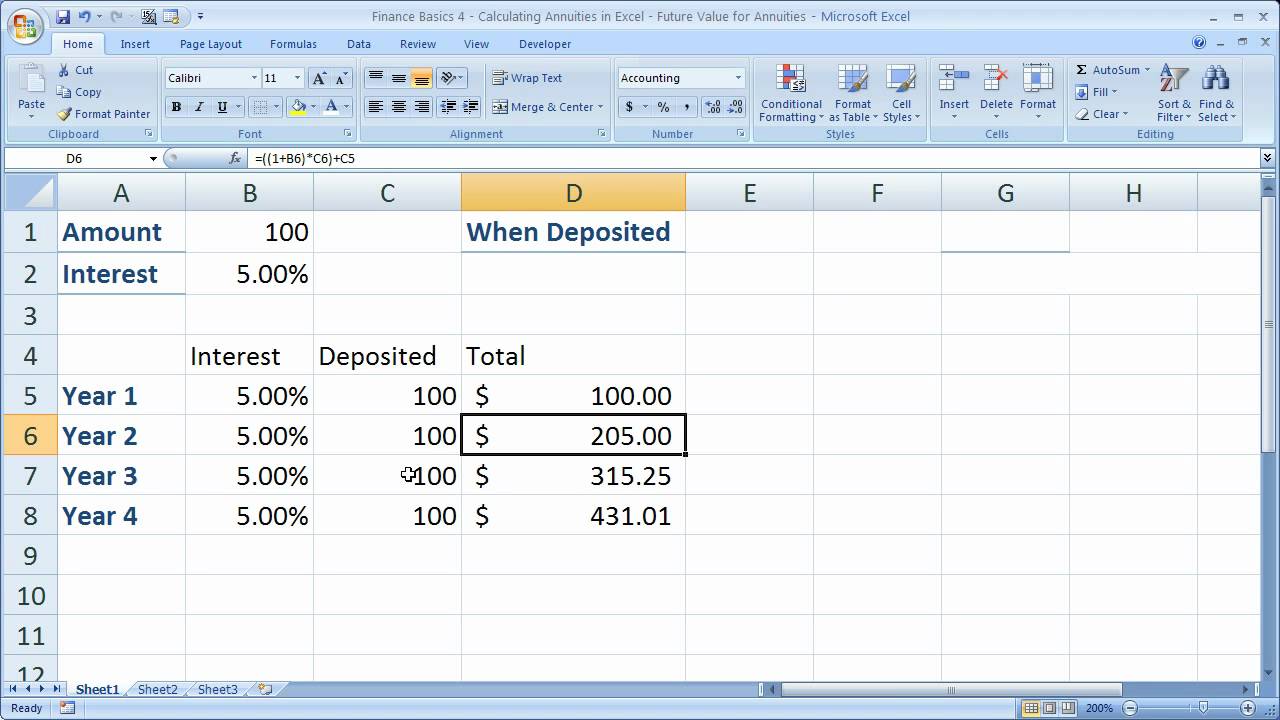

FV Pmt x 1 i n - 1 g n i - g Instructions. You can also use the FV formula to calculate other annuities such as a loan where you know your fixed payments the interest rate charged and the number of payments. Ad EYs New Global Alternative Fund Survey Shares Insights from Alternative Fund Managers.

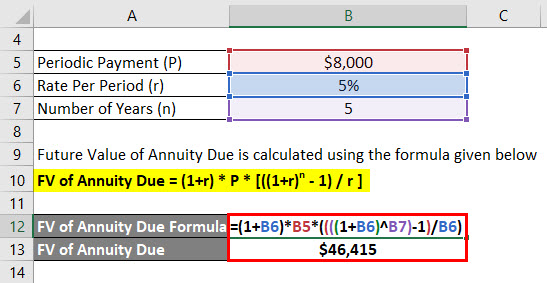

A represents the amount of periodic payment. PV Present Value. Calculate Future Value of Growing Annuity Due.

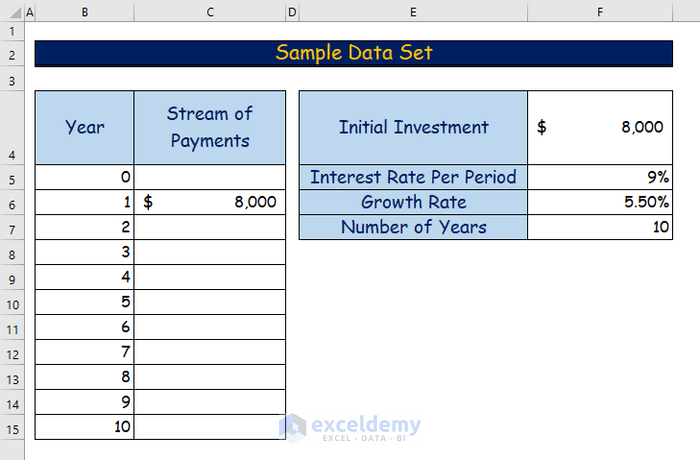

The goal in this example is to have 100000 at the end of 10 years with an interest rate of 5. For example assume that the initial payment is 100 and the payments are expected to grow each period at. Besides the present value of perpetuity can also be determined by the.

The Excel future value of a growing annuity. PMT Periodic payment. Present Value of a Growing Annuity Formula.

G growth rate. Firstly calculate the value of the future series of equal payments. A growing annuity is an annuity where the payments grow at a particular rate.

In this equation the first payment C. Here we discuss how to calculate the Annuity Due along with practical examples. C cash value of the first payment.

This is a guide to Annuity Due Formula. Calculating the present value of an annuity using Microsoft Excel is a. When using this formula.

N number of periods. The basic annuity formula in Excel for present value is PV RATENPERPMT. Ad Learn More about How Annuities Work from Fidelity.

The calculator uses the future value of a growing annuity formula as shown below. G Growth rate. Step-by-Step Procedures to Calculate Future Value of Growing Annuity in Excel.

Get the Top Priorities and Challenges of Alternative Investors During Recent Disruption. Ad Learn More about How Annuities Work from Fidelity. By using the geometric series formula the present value of a growing annuity will be shown as.

This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1. Apply Formula for Growing Annuity Due. Where PV represents the present value of a perpetuity.

R interest rate. Is the value of a current asset at a future date based on an assumed rate of growth over time. Determine Future Value of Growing Ordinary Annuity.

The future value of a growing annuity can easily be calculated by checking out all the cash flows individually. I Discount rate. We also provide an Annuity Due downloadable excel template.

An annuity is a series of equal cash flows spaced equally in time.

Present Value Of A Growing Annuity Due Formula Double Entry Bookkeeping

Periodic Payment Archives Double Entry Bookkeeping

Graduated Annuities Using Excel Tvmcalcs Com

Present Value Of A Growing Annuity Formula With Calculator

Calculating Pv Of Annuity In Excel

Future Value Of Annuity Due Formula Calculator Excel Template

Excel Formula Future Value Of Annuity Exceljet

How To Calculate Growing Annuity In Excel 2 Easy Ways

Finance Basics 4 Calculating Annuities In Excel Future Value For Annuities Youtube

Excel Formula Present Value Of Annuity Exceljet

How To Calculate Future Value Of Growing Annuity In Excel

Future Value Of An Increasing Annuity Youtube

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

How To Calculate Future Value Of Growing Annuity In Excel

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Graduated Annuities Using Excel Tvmcalcs Com